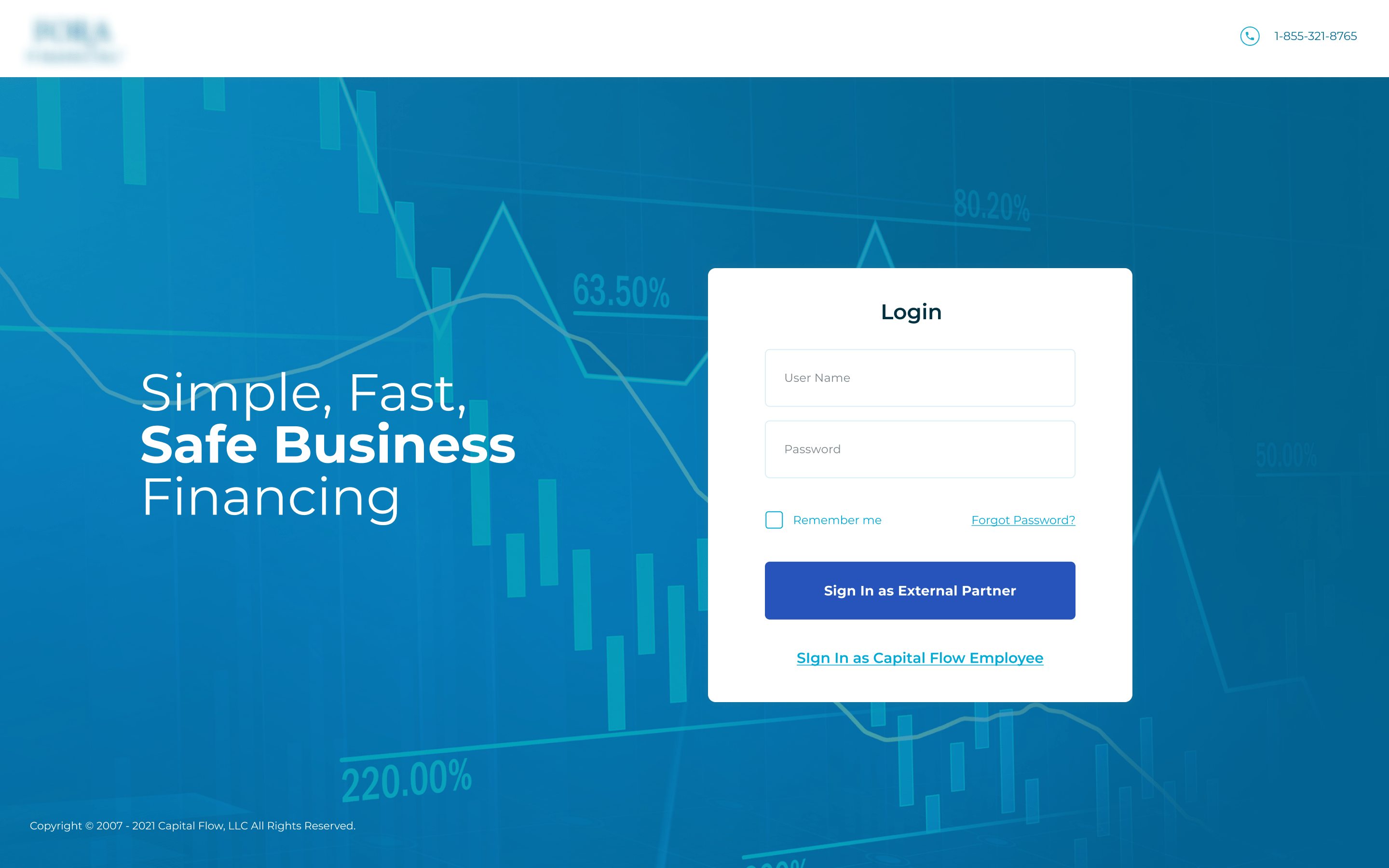

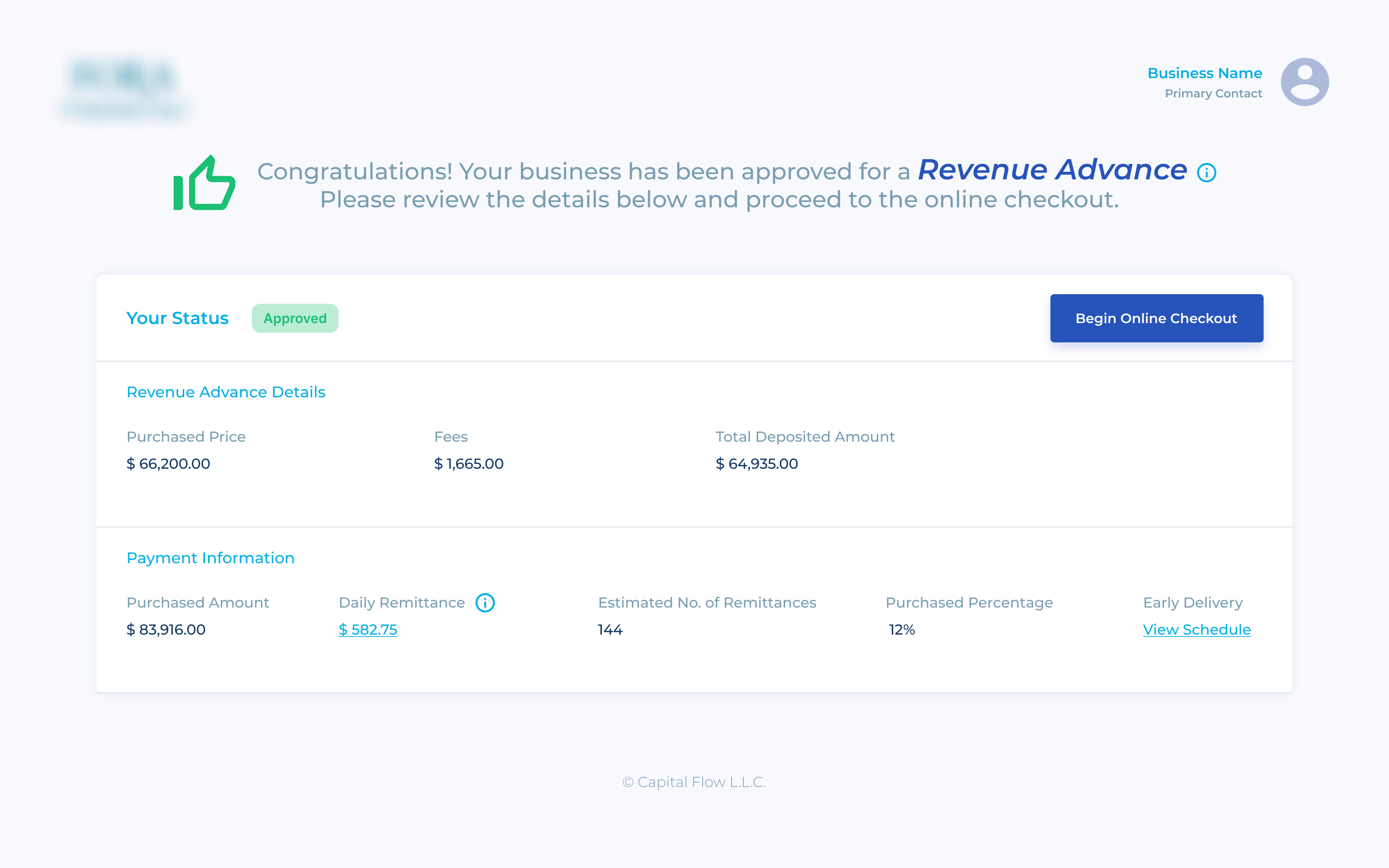

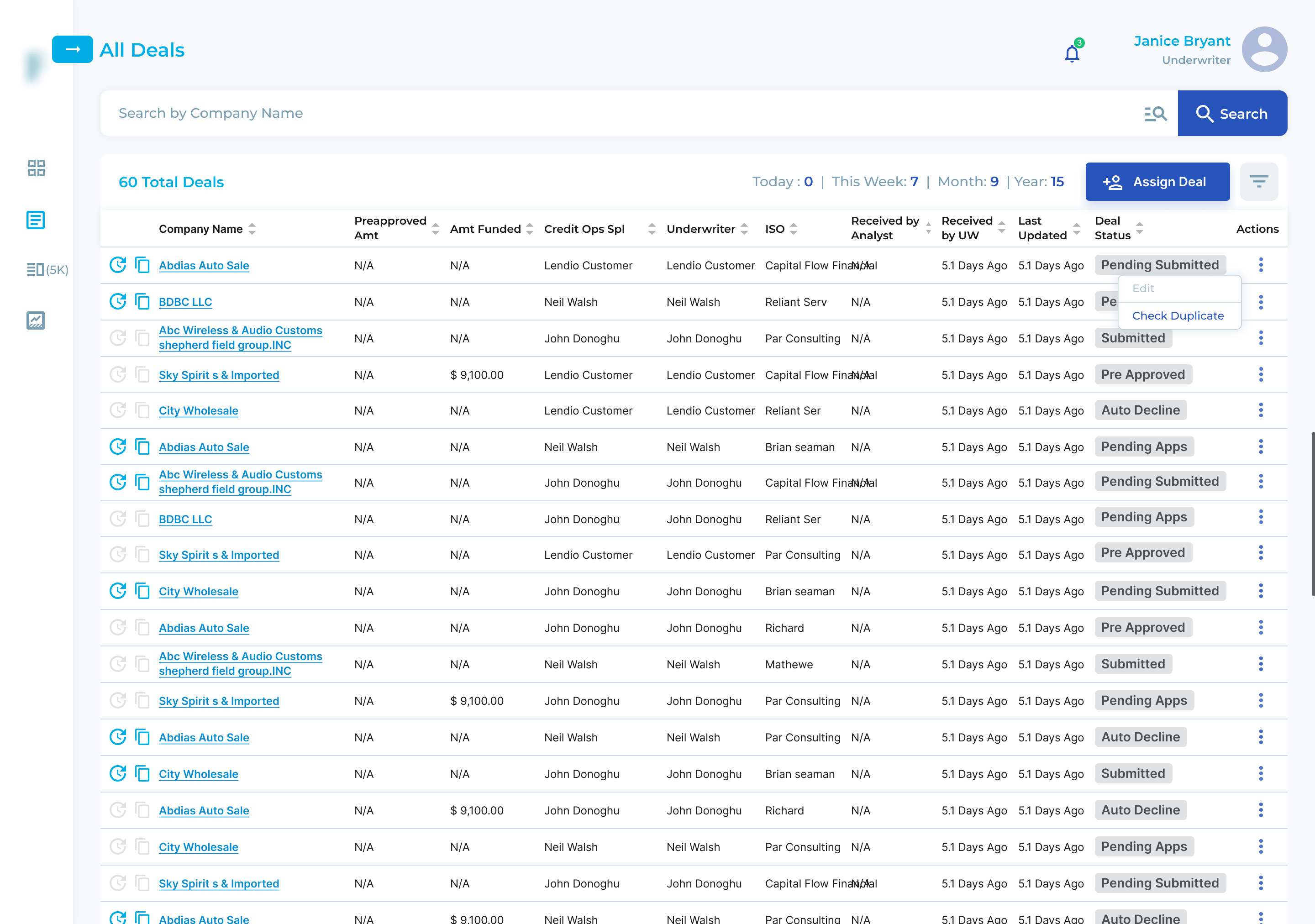

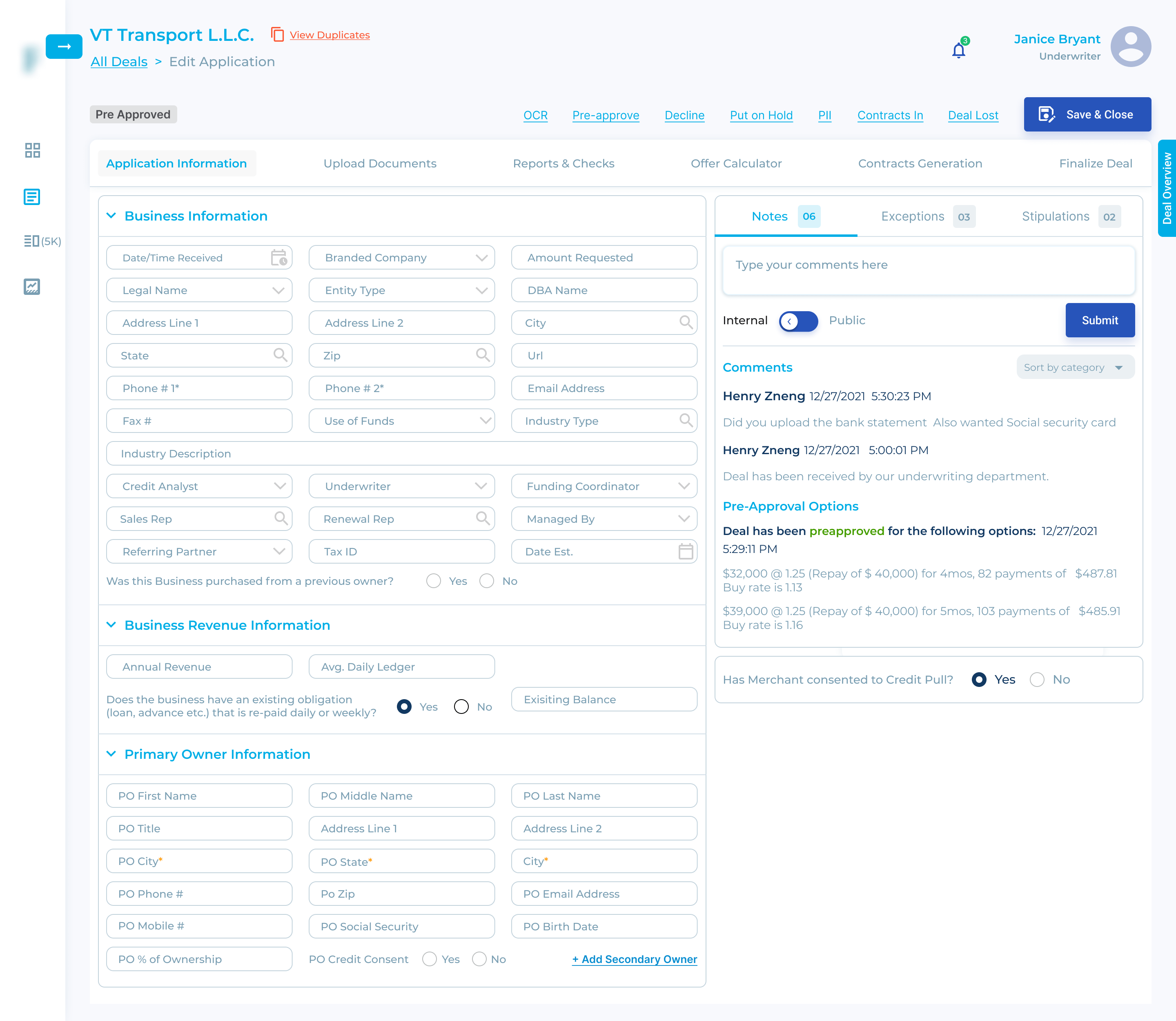

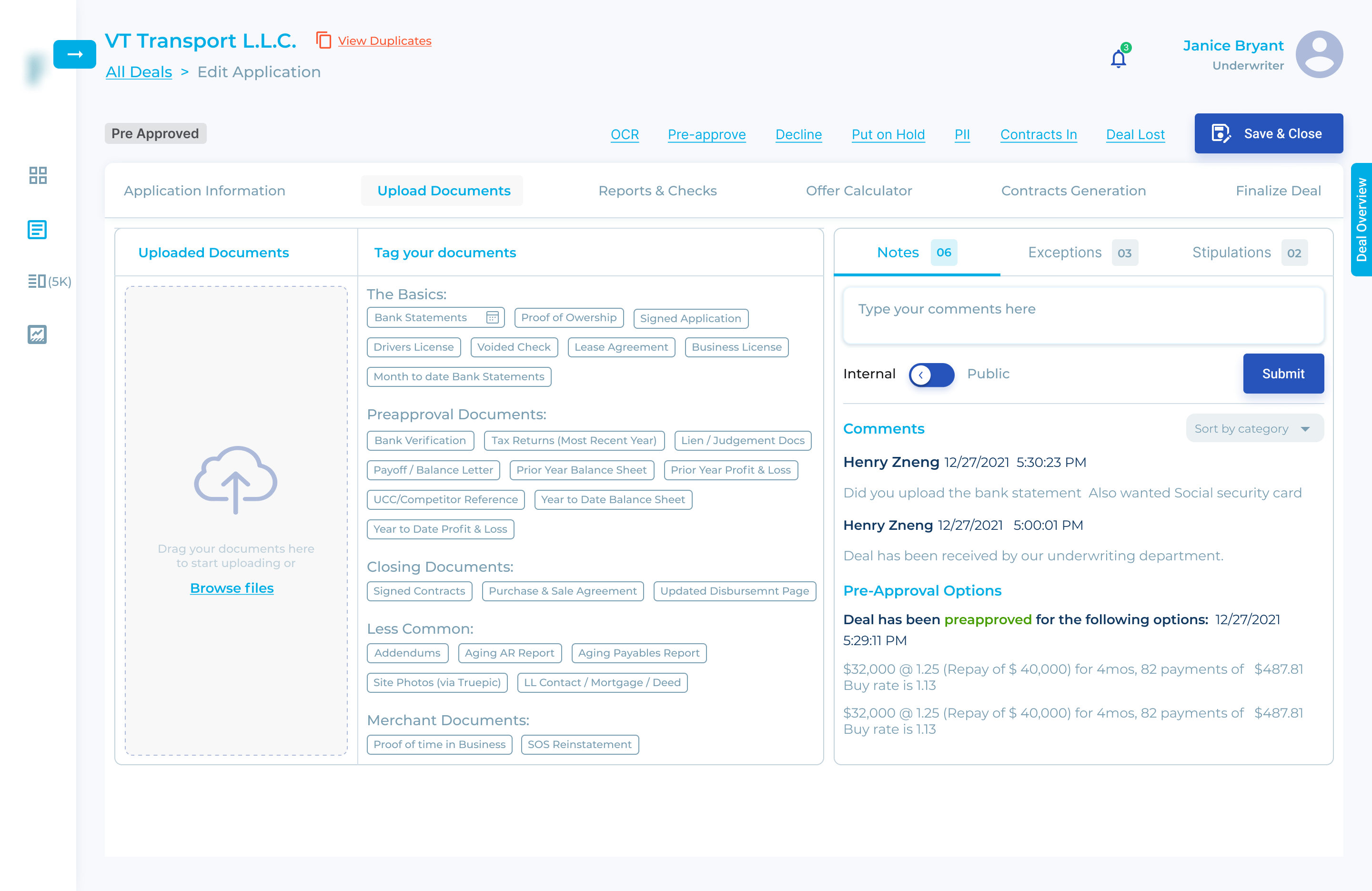

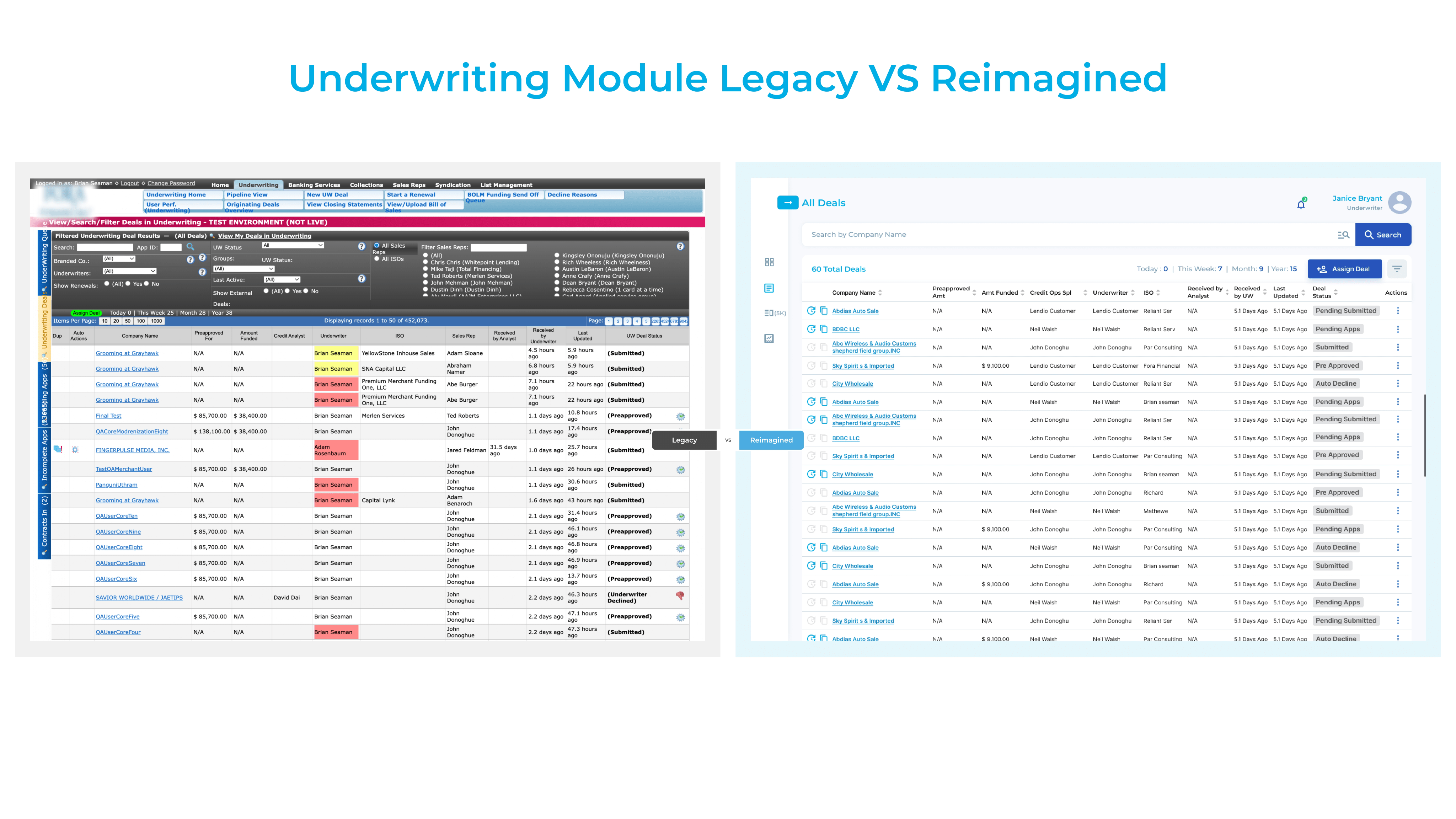

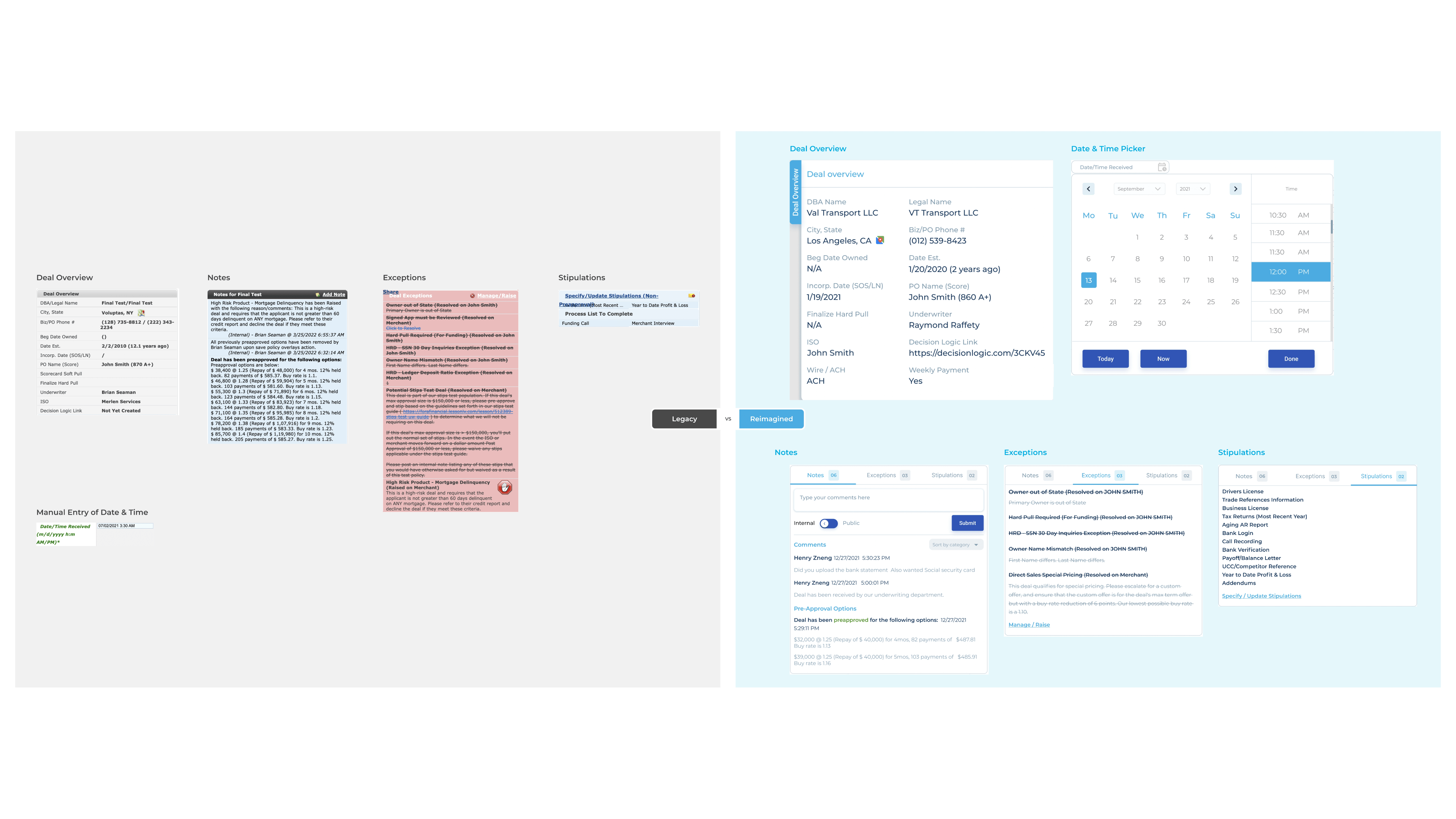

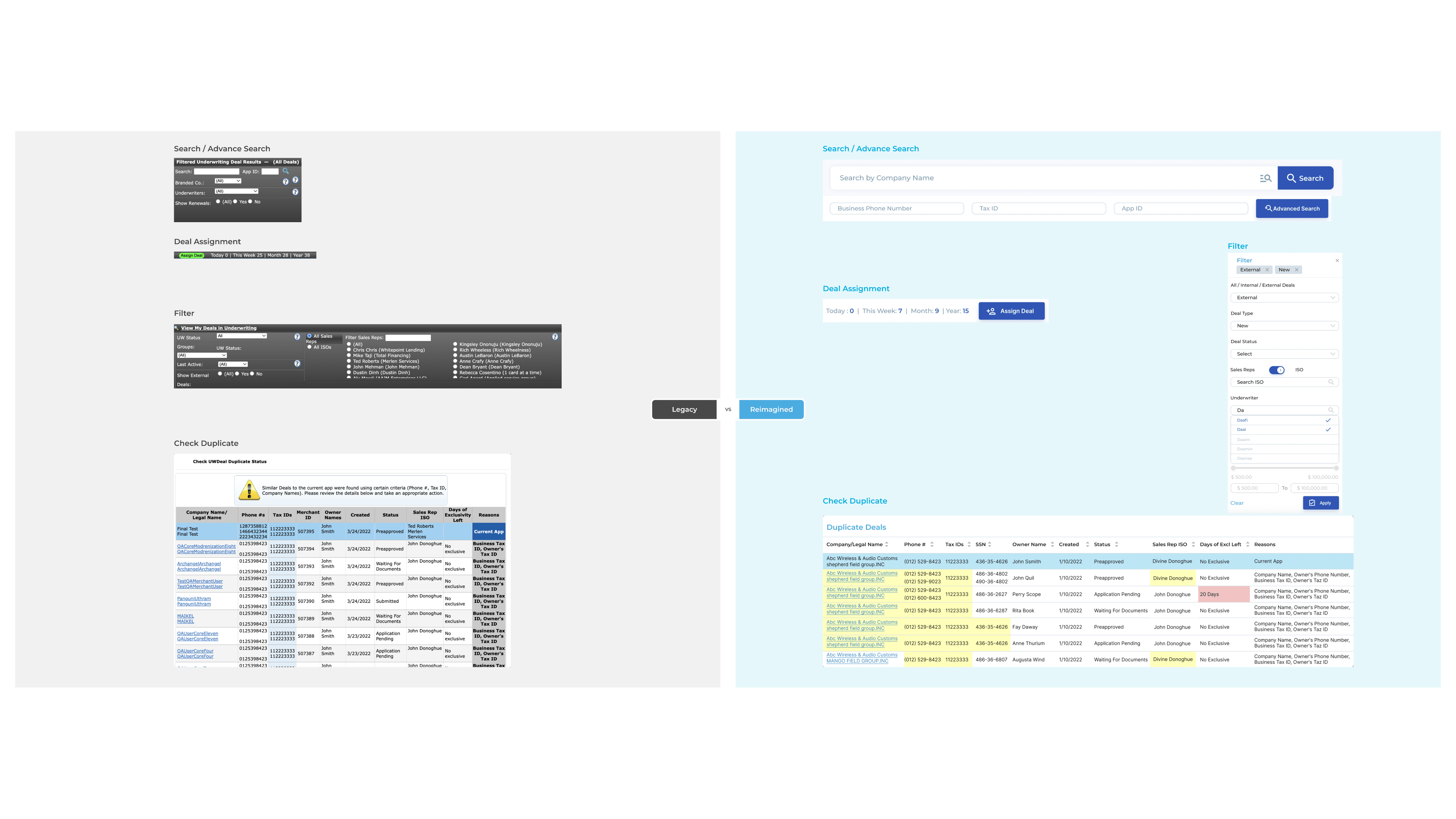

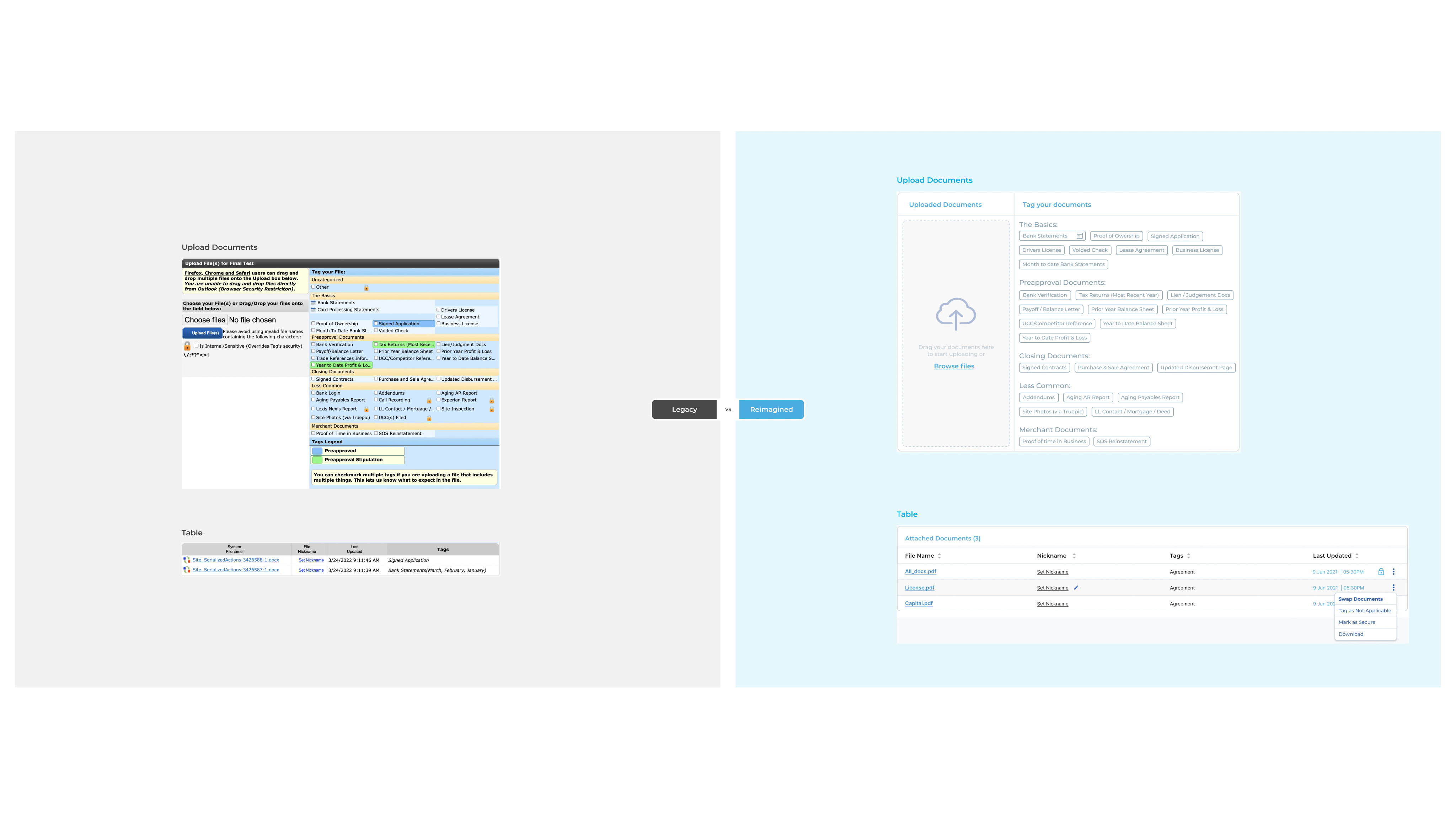

Introduction: In the dynamic realm of financial technology, I undertook a monumental project with Capital Flow, a leading provider of small business loans. The challenge at hand was the modernization of their legacy software, a behemoth that had served them for over two decades. This endeavor not only involved re-skinning the software but a comprehensive overhaul that would redefine user experiences across multiple modules.

The Problem: Capital Flow's existing software was a complex ecosystem comprising numerous modules such as Admin, ISO (Independent Sales Organization), Accounting-Merchant Funding Process, Banking Services, Underwriter, Marketing, Collections, Accounting - Syndication Partner, Syndication Partner, Legal, Renewals-New, Renewals-Underwriter, Merchant, Business Development, Direct Sales, Cash Report, Accounting-Commission, and Ledger Entry. The sheer size and age of the system posed operational challenges, leading to inefficiencies, user dissatisfaction, and a considerable gap in meeting modern business needs.

My Approach: Understanding the gravity of the task at hand, I embarked on a methodical journey to ensure the success of the Capital Flow modernization project.

Research and Analysis:

- Conducted extensive research to comprehend existing user journeys.

- Engaged in interviews with Capital Flow employees to gain insights into pain points and desired improvements.

Conceptualization and Validation:

- Utilized paper sketches to outline a conceptual framework for the new software.

- Validated concepts through iterative feedback loops, ensuring alignment with user and business goals.

UI Design:

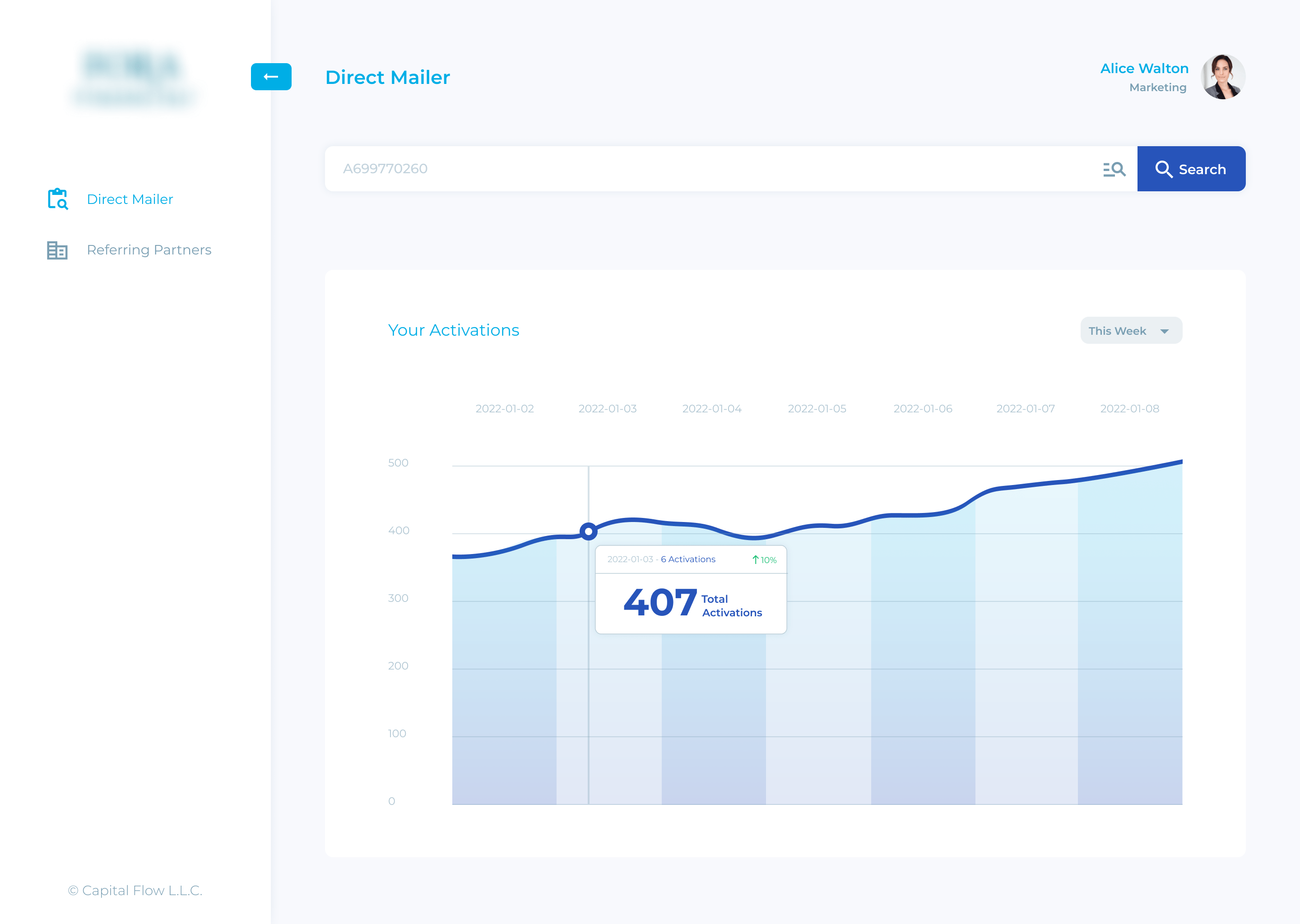

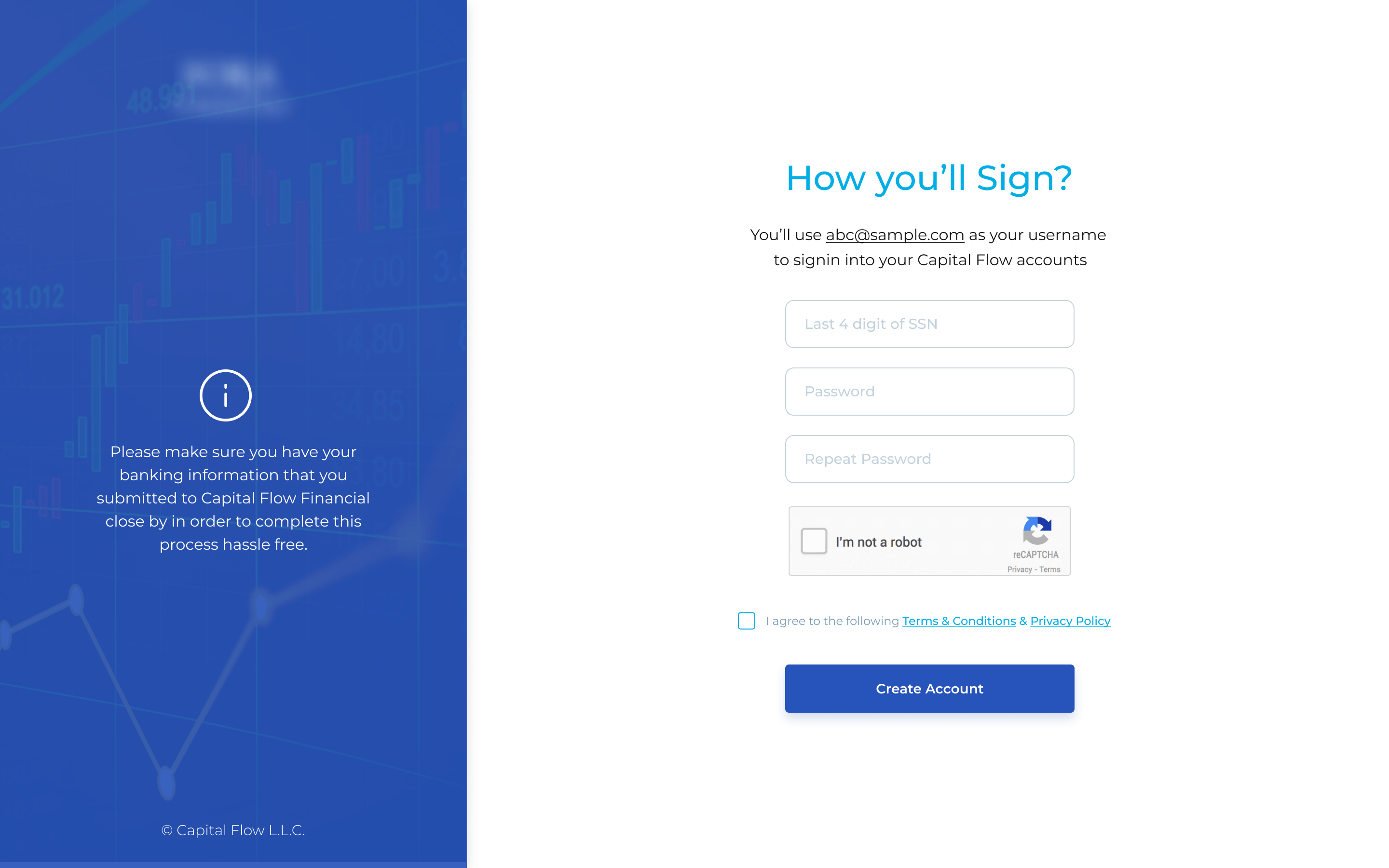

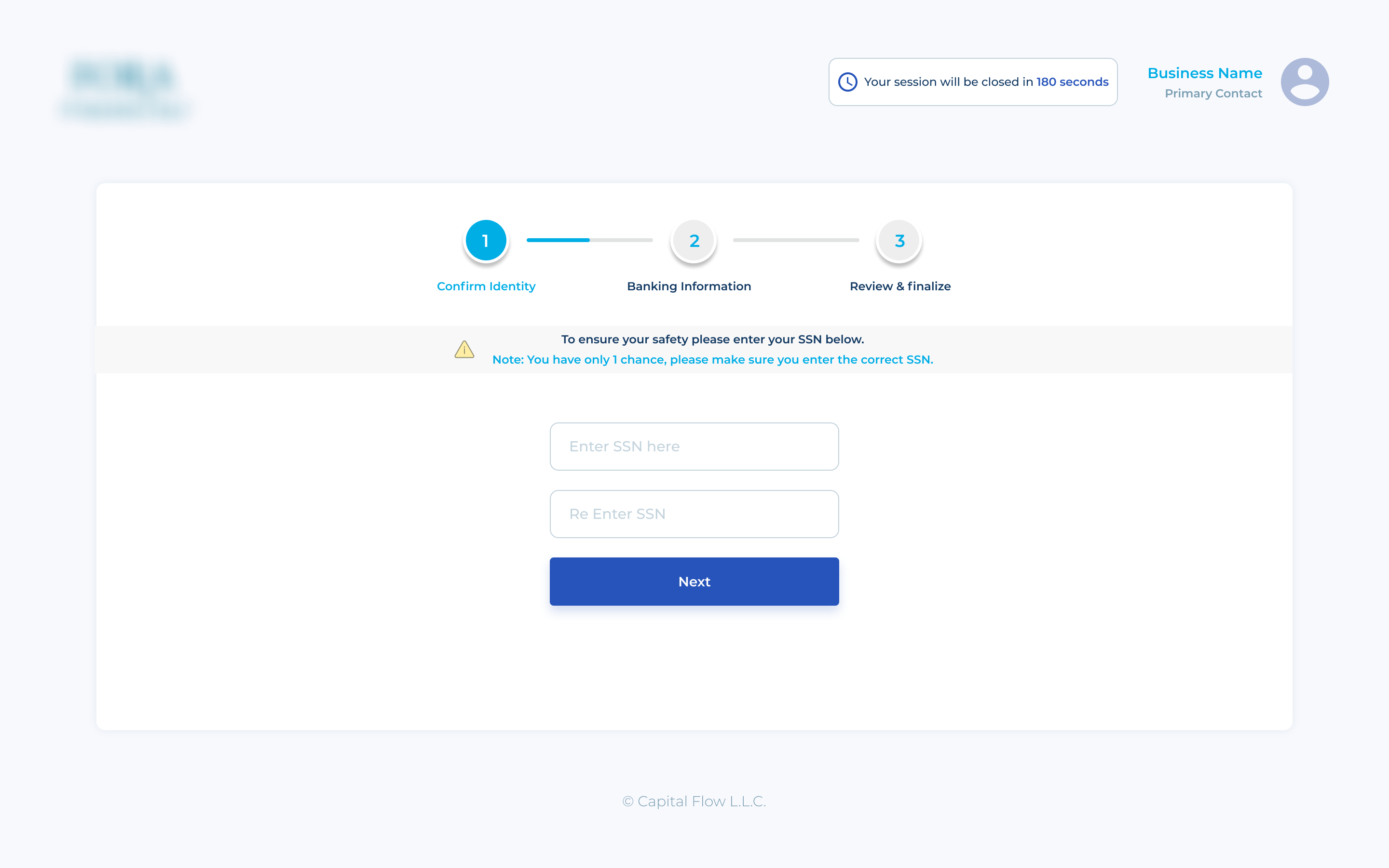

- Translated validated concepts into a visually appealing and user-friendly interface.

- Maintained consistency across modules while addressing the specific needs of each functional area.

Stakeholder Collaboration:

- Regularly showcased progress to stakeholders, incorporating their feedback into the design process.

- Ensured that the final product aligned with business objectives and user expectations.

Delivery:

- Oversaw the seamless integration of the new design into the existing infrastructure.

- Monitored the transition to guarantee minimal disruption to Capital Flow's day-to-day operations.

The Capital Flow modernization project successfully addressed the challenges posed by the aging legacy software. The new system offers improved efficiency, a more intuitive user interface, and streamlined workflows across various modules. Key stakeholders, including employees and leadership, have witnessed a positive transformation in user experiences, leading to increased productivity and overall satisfaction.

Key Takeaways:

- Undertook a comprehensive modernization effort for a complex, legacy financial software.

- Implemented user-centered design methodologies, from research to validation, UI design, and stakeholder collaboration.

- Successfully bridged the gap between legacy systems and modern user expectations.

- Delivered a scalable and efficient solution that aligns with Capital Flow's business objectives.

In conclusion, the Capital Flow project stands as a testament to my ability to navigate intricate challenges, implement user-centric solutions, and deliver transformative results in the realm of user experience design for complex financial systems.

Fintech

CategoryProduct Design / UX Design